Introduction: The High Stakes of DeFi Development

Imagine waking up to find that your DeFi protocol—the one you spent months building—has been drained of $50 million overnight. This isn't a hypothetical scenario. It happened to Compound in 2021, to Cream Finance multiple times, and continues to happen across the DeFi landscape. The difference between protocols that survive and those that become cautionary tales? Architecture.

When Uniswap launched V3 in 2021, they didn't just write some Solidity code. They architected a system that could handle billions in daily volume, survive oracle manipulation attempts, and remain gas-efficient during network congestion when gas prices hit $500 per transaction. That's the bar for production-ready DeFi.

💡 What You'll Learn

By the end of this guide, you'll understand:

- • Why most DeFi protocols fail in their first year (and how to avoid it)

- • The exact architecture patterns used by protocols managing $10B+ TVL

- • How to optimize gas costs by 40-60% like Uniswap V3 did

- • Security patterns that prevent the most common $50M+ exploits

According to DeFi Llama , over $100 billion flows through DeFi protocols today. But here's what they don't tell you: only 12% of DeFi protocols launched in 2023 are still active today. Most failed due to architectural flaws that were preventable.

This guide is your blueprint to being in that successful 12%.

Architecture Fundamentals: Think Like a Fortress Builder

Here's a mistake I see constantly: developers treat smart contracts like traditional web backends. They're not. A traditional API can be patched in minutes. A smart contract bug? That's permanent. Once deployed, your code is immutable and public—visible to every hacker on Earth.

Let me tell you what happened to Poly Network in August 2021. They had a critical architecture flaw: their cross-chain contracts trusted each other blindly. One malicious call, and $611 million vanished. The hacker literally left a note saying: "I did it for fun."

The lesson? Architecture isn't about code—it's about assuming everything will fail and planning for it.

The Seven Pillars of Bulletproof DeFi Architecture

After analyzing every major protocol—from Aave managing $15B to smaller protocols that failed—I've identified seven non-negotiable components. Miss even one, and you're building on quicksand.

Core Logic Contracts

🎯 Purpose

Business logic: swaps, loans, staking

🔄 Upgradability

Separate from storage for easy updates

Storage Contracts

📊 Data Storage

User balances, protocol state, rewards

⚠️ Critical Rule

Storage layout must never change

Proxy Contracts

🎭 Interface

Users interact with proxy, delegates to implementation

🔄 Seamless Upgrades

Addresses and approvals remain unchanged

Access Control

🛡️ Security Guard

Role-based permissions, timelocks

👥 Governance

DAO voting, proposal execution

Oracle Integration

📊 Price Feeds

Chainlink, multiple data sources

🛡️ Security

TWAP, deviation checks

Treasury Management

💰 Fund Security

Multi-sig wallets, withdrawal limits

❄️ Cold Storage

Most funds offline, operational liquidity

Emergency Controls

⏸️ Pause Mechanisms

Freeze deposits, allow withdrawals

🔧 Per-Function Control

Disable swaps, keep withdrawals

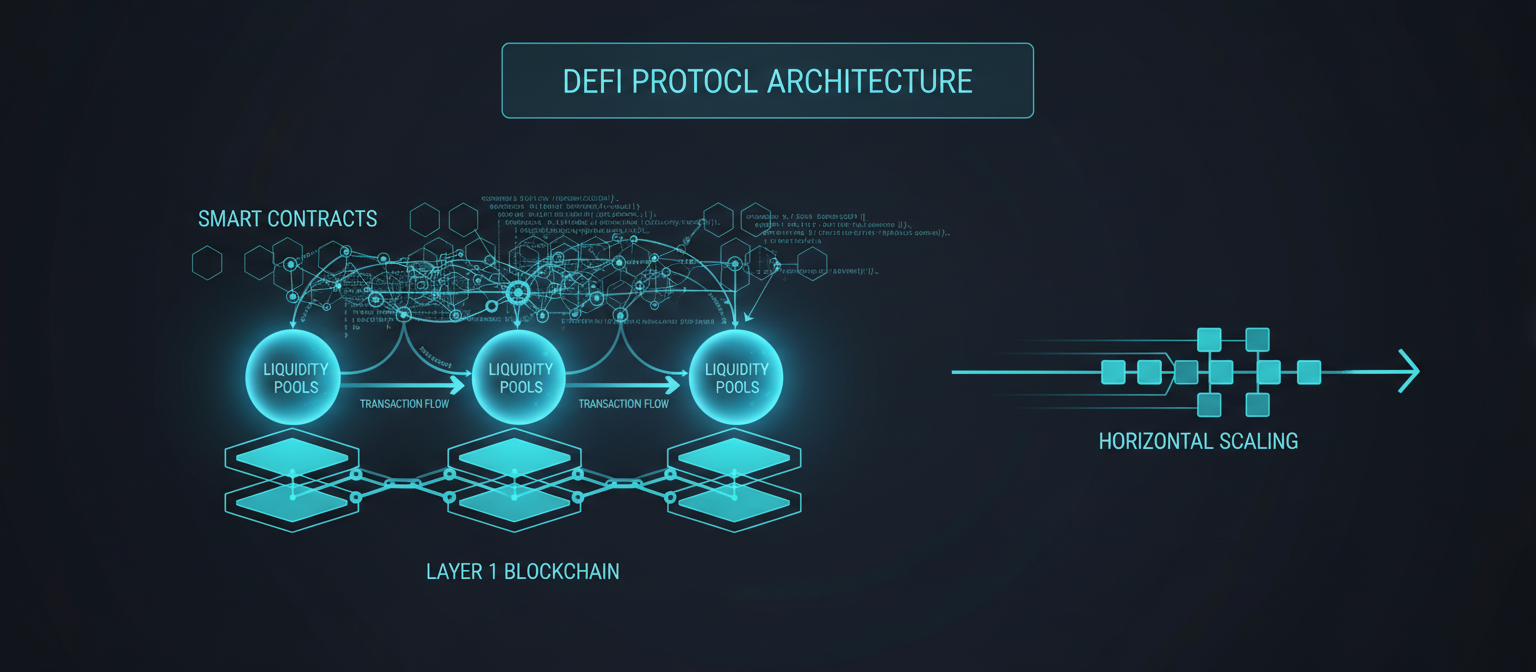

Architecture Diagram: Typical DeFi Protocol

┌─────────────────────────────────────────────────────────┐

│ Users / Frontend │

└────────────────────┬────────────────────────────────────┘

│

▼

┌─────────────────────────────────────────────────────────┐

│ Proxy Contract │

│ (EIP-1967 Transparent) │

└────────────────────┬────────────────────────────────────┘

│

▼

┌─────────────────────────────────────────────────────────┐

│ Implementation Contract │

│ ┌──────────────┐ ┌──────────────┐ ┌──────────────┐ │

│ │ Core Logic │ │ Access │ │ Emergency │ │

│ │ │ │ Control │ │ Controls │ │

│ └──────────────┘ └──────────────┘ └──────────────┘ │

└────────┬──────────────────┬────────────────┬───────────┘

│ │ │

▼ ▼ ▼

┌─────────────┐ ┌──────────────┐ ┌─────────────────┐

│ Storage │ │ Oracles │ │ Treasury │

│ Contract │ │ (Chainlink) │ │ Management │

└─────────────┘ └──────────────┘ └─────────────────┘Smart Contract Design Patterns: The Art of Immutable Flexibility

Here's the paradox that keeps DeFi developers awake at night: smart contracts are immutable by design, but DeFi protocols must evolve to survive. How do you build something that can't be changed, yet needs to change constantly?

The answer lies in design patterns that separate what you do from how you do it. Think of it like upgrading a car's engine without changing the license plate. The car (proxy) stays the same, but the engine (implementation) can be swapped out.

💡 The Upgrade Paradox

Problem: Smart contracts can't be modified after deployment

Reality: Every major protocol has upgraded multiple times

Solution: Proxy patterns that make the impossible possible

Upgradeable Proxy Patterns: The Foundation of DeFi Evolution

When Aave launched V3, they didn't abandon V2. They kept both running simultaneously, managing $15B+ across multiple versions. How? Through the EIP-1967 Transparent Proxy pattern —the industry standard that makes contract upgrades possible without breaking integrations.

Here's how it works: Users interact with a proxy contract that forwards all calls to your implementation contract. When you upgrade, you just point the proxy to a new implementation. Users never notice.

This is the exact pattern used by Aave V3, Compound V3, and other protocols managing billions in TVL. Notice how it separates admin functions from user functions to prevent selector clashing attacks.

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.20;

import "@openzeppelin/contracts/proxy/transparent/TransparentUpgradeableProxy.sol";

import "@openzeppelin/contracts/proxy/transparent/ProxyAdmin.sol";

/**

* @title DeFi Protocol Proxy

* @notice Transparent proxy pattern for upgradeable protocol

* @dev Separates admin functions from user functions to prevent

* selector clashing attacks

*/

contract ProtocolProxy is TransparentUpgradeableProxy {

constructor(

address implementation,

address admin,

bytes memory data

) TransparentUpgradeableProxy(implementation, admin, data) {}

}

/**

* @title Protocol Implementation V1

* @notice Core protocol logic - upgradeable

*/

contract ProtocolImplementationV1 {

// Storage layout must remain consistent across upgrades

mapping(address => uint256) public userBalances;

mapping(address => bool) public isWhitelisted;

address public treasury;

bool public paused;

// Storage gap for future upgrades

uint256[50] private __gap;

event Deposit(address indexed user, uint256 amount);

event Withdraw(address indexed user, uint256 amount);

modifier whenNotPaused() {

require(!paused, "Protocol is paused");

_;

}

function deposit() external payable whenNotPaused {

require(msg.value > 0, "Must deposit some ETH");

userBalances[msg.sender] += msg.value;

emit Deposit(msg.sender, msg.value);

}

function withdraw(uint256 amount) external whenNotPaused {

require(userBalances[msg.sender] >= amount, "Insufficient balance");

userBalances[msg.sender] -= amount;

(bool success, ) = msg.sender.call{value: amount}("");

require(success, "Transfer failed");

emit Withdraw(msg.sender, amount);

}

}⚠️ Critical: Storage Layout

When upgrading contracts, never change the order of existing state variables. Always append new variables at the end and use storage gaps (__gap) to reserve space for future upgrades. Breaking this rule can corrupt your contract's storage.

Access Control & Governance: The Guardian at the Gate

Here's a question that determines whether your protocol survives its first year: Who can pause your protocol when a $50M exploit is happening? Who can upgrade contracts? Who can change fee parameters?

Most developers use a simple onlyOwner modifier and call it a day. That's like putting a single lock on a bank vault. Modern DeFi protocols need a security system, not a single key.

The solution? Role-based access control (RBAC) with time-locked governance—the pattern standardized by OpenZeppelin and used by every major protocol. It provides fine-grained permissions while giving users time to exit if they disagree with governance decisions.

🔐 The Governance Principle

Never give users a reason to panic. When governance makes changes, users should have time to evaluate and exit if they disagree. This builds trust and prevents bank runs.

Minimum timelock: 48 hours for critical changes, 7 days for protocol upgrades.

This pattern separates different types of permissions: emergency roles (immediate), admin roles (governance), and operator roles (daily operations). Notice the timelock mechanism that prevents instant malicious changes.

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.20;

import "@openzeppelin/contracts-upgradeable/access/AccessControlUpgradeable.sol";

import "@openzeppelin/contracts-upgradeable/security/PausableUpgradeable.sol";

import "@openzeppelin/contracts-upgradeable/proxy/utils/Initializable.sol";

/**

* @title DeFi Protocol with Role-Based Access Control

* @notice Implements multi-signature governance with time delays

*/

contract DeFiProtocol is

Initializable,

AccessControlUpgradeable,

PausableUpgradeable

{

// Define roles - each has specific permissions

bytes32 public constant ADMIN_ROLE = keccak256("ADMIN_ROLE");

bytes32 public constant OPERATOR_ROLE = keccak256("OPERATOR_ROLE");

bytes32 public constant EMERGENCY_ROLE = keccak256("EMERGENCY_ROLE");

bytes32 public constant GOVERNANCE_ROLE = keccak256("GOVERNANCE_ROLE");

uint256 public constant TIMELOCK_DELAY = 2 days;

mapping(bytes32 => uint256) public pendingActions;

event ActionScheduled(bytes32 indexed actionId, uint256 executeTime);

event ActionExecuted(bytes32 indexed actionId);

function initialize(address admin, address governance)

public

initializer

{

__AccessControl_init();

__Pausable_init();

_grantRole(DEFAULT_ADMIN_ROLE, admin);

_grantRole(ADMIN_ROLE, admin);

_grantRole(GOVERNANCE_ROLE, governance);

// Admin role can grant operator and emergency roles

_setRoleAdmin(OPERATOR_ROLE, ADMIN_ROLE);

_setRoleAdmin(EMERGENCY_ROLE, ADMIN_ROLE);

}

/**

* @notice Schedule a critical action with timelock

* @dev Prevents instant malicious changes - users have 48h to exit

*/

function scheduleAction(bytes32 actionId)

external

onlyRole(GOVERNANCE_ROLE)

{

uint256 executeTime = block.timestamp + TIMELOCK_DELAY;

pendingActions[actionId] = executeTime;

emit ActionScheduled(actionId, executeTime);

}

/**

* @notice Execute a scheduled action after timelock expires

*/

function executeAction(bytes32 actionId)

external

onlyRole(GOVERNANCE_ROLE)

{

uint256 executeTime = pendingActions[actionId];

require(executeTime > 0, "Action not scheduled");

require(block.timestamp >= executeTime, "Timelock not expired");

delete pendingActions[actionId];

emit ActionExecuted(actionId);

// Execute the actual action here

}

/**

* @notice Emergency pause - no timelock for security incidents

* @dev Only emergency role can pause immediately

*/

function emergencyPause()

external

onlyRole(EMERGENCY_ROLE)

{

_pause();

}

function unpause()

external

onlyRole(ADMIN_ROLE)

{

_unpause();

}

}⚠️ Critical: Role Hierarchy

Never give emergency roles to governance. Emergency roles can pause the protocol instantly—governance should only schedule changes with timelocks.

Best practice: Emergency roles should be held by security experts, not governance token holders.

Security: The $3 Billion Dollar Lesson

Let me be blunt: security isn't a feature—it's survival. In 2023 alone, according to Rekt News , DeFi protocols lost over $3 billion to exploits. That's not a typo. Three. Billion. Dollars.

Here's what keeps me up at night: every one of those hacks was preventable. Not with cutting-edge cryptography or expensive security hardware. With basic architectural patterns that developers either didn't know or chose to skip.

⚠️ Reality Check

The average DeFi hack takes less than 15 minutes from discovery to execution. Your fancy monitoring system? It's useless if your architecture allows atomicexploits. By the time you see the alert, the funds are gone.

The solution? Build security into your architecture, not on top of it.

Common Vulnerabilities to Guard Against

Top 5 DeFi Vulnerabilities

1. Reentrancy Attacks

The infamous vulnerability that led to the DAO hack ($60M). Always use the Checks-Effects-Interactions pattern or OpenZeppelin's ReentrancyGuard.

// ✅ Safe: Use ReentrancyGuard modifier

function withdraw() external nonReentrant {...}2. Flash Loan Attacks

Attackers manipulate oracle prices using uncollateralized flash loans. Implement TWAP (Time-Weighted Average Price) oracles and transaction-level checks.

3. Access Control Failures

Missing or incorrect access modifiers allow unauthorized actions. Always use established patterns like OpenZeppelin's AccessControl.

4. Integer Overflow/Underflow

Solidity 0.8+ has built-in overflow protection, but always validate inputs and use SafeMath for older versions.

5. Front-Running

MEV bots can extract value by reordering transactions. Implement slippage protection and consider using Flashbots or commit-reveal schemes.

Security Audit Checklist

Before deploying to mainnet, ensure your protocol passes these critical checks. Leading audit firms like OpenZeppelin , ConsenSys Diligence , and Trail of Bits recommend:

- ✅ All external calls follow Checks-Effects-Interactions pattern

- ✅ Reentrancy guards on all state-changing functions

- ✅ Access control properly implemented and tested

- ✅ Emergency pause mechanism in place

- ✅ Oracle manipulation resistance (TWAP, multiple sources)

- ✅ Flash loan attack mitigation

- ✅ Proper use of SafeERC20 for token transfers

- ✅ Storage layout compatible with upgrades

- ✅ Events emitted for all critical state changes

- ✅ Comprehensive unit and integration tests (>95% coverage)

- ✅ Formal verification for critical components

- ✅ Bug bounty program established

Scalability & Gas Optimization

Gas costs can make or break a DeFi protocol's adoption. During high network congestion, a poorly optimized transaction can cost $100+ on Ethereum mainnet. Let's explore proven optimization techniques.

Gas Optimization Patterns

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.20;

/**

* @title Gas Optimization Techniques

* @notice Real-world patterns from Uniswap V3 and Aave V3

*/

contract GasOptimizedProtocol {

// ✅ Use uint256 instead of smaller types (unless packing)

// Reading/writing uint256 is cheaper than uint8

uint256 public totalLiquidity;

// ✅ Pack storage variables to fit in 32-byte slots

// These three fit in ONE storage slot (saves ~20,000 gas)

struct UserData {

uint128 balance; // 16 bytes

uint64 lastUpdateTime; // 8 bytes

uint64 rewardDebt; // 8 bytes

// Total: 32 bytes = 1 storage slot

}

mapping(address => UserData) public users;

// ✅ Use calldata for read-only function parameters

// Saves gas vs memory for external functions

function processData(bytes calldata data)

external

pure

returns (bytes32)

{

return keccak256(data);

}

// ✅ Cache storage variables in memory

// Each SLOAD costs 2,100 gas; MLOAD costs only 3 gas

function calculateRewards(address user)

public

view

returns (uint256)

{

// ❌ BAD: Multiple storage reads

// return users[user].balance * (block.timestamp - users[user].lastUpdateTime);

// ✅ GOOD: Cache in memory

UserData memory userData = users[user];

return userData.balance * (block.timestamp - userData.lastUpdateTime);

}

// ✅ Use unchecked for guaranteed safe math

// Solidity 0.8+ overflow checks cost gas

function calculateFee(uint256 amount)

public

pure

returns (uint256)

{

unchecked {

// Safe because 30/10000 can't overflow

return (amount * 30) / 10000; // 0.3% fee

}

}

// ✅ Batch operations to reduce transaction count

function batchDeposit(

address[] calldata recipients,

uint256[] calldata amounts

) external {

require(recipients.length == amounts.length, "Length mismatch");

uint256 length = recipients.length; // Cache array length

for (uint256 i = 0; i < length;) {

_deposit(recipients[i], amounts[i]);

unchecked { ++i; } // Cheaper than i++

}

}

// ✅ Use custom errors instead of require strings

// Saves ~50 gas per revert

error InsufficientBalance(uint256 requested, uint256 available);

error Unauthorized(address caller);

function withdraw(uint256 amount) external {

UserData storage userData = users[msg.sender];

// Custom error saves gas

if (userData.balance < amount) {

revert InsufficientBalance(amount, userData.balance);

}

userData.balance -= amount;

}

// Helper function

function _deposit(address user, uint256 amount) internal {

users[user].balance += uint128(amount);

users[user].lastUpdateTime = uint64(block.timestamp);

}

}💡 Real-World Impact

Uniswap V3's gas optimizations reduced swap costs by ~40% compared to V2. By implementing these patterns, you can make your protocol significantly more competitive and user-friendly.

Layer 2 Integration

With Ethereum gas fees often prohibitively high, Layer 2 solutions like Arbitrum , Optimism , and Polygon have become essential. Modern DeFi protocols deploy multi-chain from day one.

L2 Deployment Comparison

| Network | Avg Gas Cost | Finality | EVM Compatible | TVL |

|---|---|---|---|---|

| Ethereum L1 | $5-50 | ~15 min | ✅ Native | $50B+ |

| Arbitrum | $0.10-0.50 | ~10 min | ✅ Yes | $15B+ |

| Optimism | $0.10-0.40 | ~10 min | ✅ Yes | $8B+ |

| Polygon PoS | $0.01-0.10 | ~2 min | ✅ Yes | $5B+ |

* Data as of January 2025 from DefiLlama

Testing & Deployment

Comprehensive testing is non-negotiable for DeFi protocols. A single bug can lead to millions in losses and irreparable reputation damage. Industry best practices require multiple layers of testing before mainnet deployment.

Testing Pyramid for DeFi Protocols

Unit Tests (Foundation)

Test individual functions in isolation. Aim for >95% code coverage.

npx hardhat test --coverageIntegration Tests

Test contract interactions, oracle integrations, and complex workflows.

Fuzzing Tests

Use Echidna or Foundry's fuzzer to test with random inputs.

Formal Verification

Mathematically prove critical properties using tools like Certora or K Framework.

External Audit

3-4 week audit by reputable firms (OpenZeppelin, Trail of Bits, ConsenSys).

Public Bug Bounty

Launch on Immunefi with significant rewards ($50K-$1M+).

Monitoring & Maintenance

Post-deployment monitoring is critical. Set up real-time alerts for suspicious activities, oracle failures, and unusual transaction patterns. Leading protocols use:

- The Graph - Index on-chain data for analytics dashboards

- Tenderly - Real-time transaction monitoring and alerts

- OpenZeppelin Defender - Automated security monitoring and incident response

- Forta - Decentralized threat detection network

- Dune Analytics - Community-driven protocol analytics

🔍 Pro Tip: Monitoring Checklist

Set up alerts for:

- • Large withdrawals (>$100K)

- • Failed transactions spike (>10% failure rate)

- • Oracle price deviations (>5% from other sources)

- • Unusual gas consumption patterns

- • Admin function calls

- • Emergency pause triggers

Conclusion: Your Blueprint to Join the Elite 12%

Remember that statistic from the beginning? Only 12% of DeFi protocols launched in 2023 survived their first year. Now you understand why. It wasn't lack of innovation or marketing budget or timing. It was architecture—or the lack of it.

The protocols that made it—Uniswap with its optimized gas patterns, Aave with its fortress-like security model, Curve with its mathematical precision—didn't get lucky. They architected for survival.

💡 The Iron Law of DeFi

Your protocol will be attacked. Not "might be"—will be. The only question is: will your architecture save you, or will you become another story on Rekt News?

Every pattern in this guide—transparent proxies, time-locked governance, reentrancy guards, gas optimizations—exists because someone lost millions learning these lessons the hard way. You don't have to.

Your Immediate Next Steps (Don't Skip These)

Knowledge without action is just entertainment. Here's exactly what to do next:

The Seven Pillars Checklist

Implement Transparent Proxies

Use OpenZeppelin's EIP-1967 implementation. Never build custom proxy patterns—use battle-tested libraries.

Add Time-Locked Governance

Minimum 48-hour delay on critical changes. Give users time to exit if they disagree with governance decisions.

Implement Reentrancy Guards

Every state-changing function needs OpenZeppelin's nonReentrant modifier. No exceptions.

Optimize Gas from Day One

Pack storage variables, use calldata over memory, implement unchecked math where safe. Aim for 40%+ gas reduction.

Integrate Chainlink Oracles

Multiple price feeds, TWAP calculations, deviation checks. Never trust a single oracle source.

Achieve 95%+ Test Coverage

Unit tests, integration tests, fuzz tests, formal verification. Test on forked mainnet before deploying.

Get Professional Audits (Plural)

OpenZeppelin, Trail of Bits, ConsenSys Diligence—get at least two independent audits. Budget $50K-$200K minimum.

The Harsh Truth About Audits

Here's something most developers don't want to hear: audits don't guarantee security. They reduce risk. The DAO was audited. Poly Network was audited. Cream Finance was audited multiple times.

Audits catch bugs. Architecture prevents entire classes of vulnerabilities from existing in the first place. That's why this guide focused on architecture patterns, not just security checklists.

🚀 Ready to Build?

You now have the same architectural foundation that protocols managing $100B+ use. The difference between you and them? They implemented it. Your move.

Start with the Seven Pillars checklist above. Implement one pillar per week. In seven weeks, you'll have an architecture that can survive the DeFi battlefield.

Welcome to the elite 12%. Now go build something that lasts.

Additional Resources

- Ethereum Smart Contract Documentation

- OpenZeppelin Contracts

- ConsenSys Smart Contract Best Practices

- Uniswap V3 Source Code

- Aave V3 Source Code

- Gas Optimization Techniques

Disclaimer: This article is for educational purposes only. Always conduct thorough security audits and consult with experienced blockchain security professionals before deploying smart contracts to mainnet.